All right, well, good afternoon, everyone. All right, do these mics work? That's good, thank you so much for joining us on a busy day in Washington for today's briefing on what's next for Medicare provider payments. My name is Sarah. I am president and CEO of the Alliance for Health Policy. For those who are not familiar with the Alliance, we are a nonpartisan organization dedicated to advancing knowledge and understanding of health policy issues. So we're really glad you're here. And hello as well to those who might be on Twitter at the hashtag all health live. And you all can feel free to tweet while you're here and feel free to submit questions that way as well. Before we get started, I'd like to thank the Commonwealth Fund for making today's briefing possible and for their partnership and support. So let's dive into the topic. - After a deliberative process lasting since the passage of the Medicare Access and CHIP Reauthorization Act in 2015, earlier in November, CMS released its final rule pertaining to MACRA's Quality Payment Program. And as we know, efforts are well underway around the country to encourage a shift to value-based payment models for Medicare providers. That means while the Medicare Payment Advisory Commission (MedPAC) recently recommended a move away from the key component of MACRA, the Merit-Based Incentive Payment System, towards a different approach to value-based payment. And there are many challenges and complexities to the implementation of many of these measures. So we're here today to examine the issues that are on the table as healthcare providers around the country work to understand and implement these measures. And as policymakers consider additional shifts to the way providers might be paid and what all this really means for improving health outcomes and quality...

Award-winning PDF software

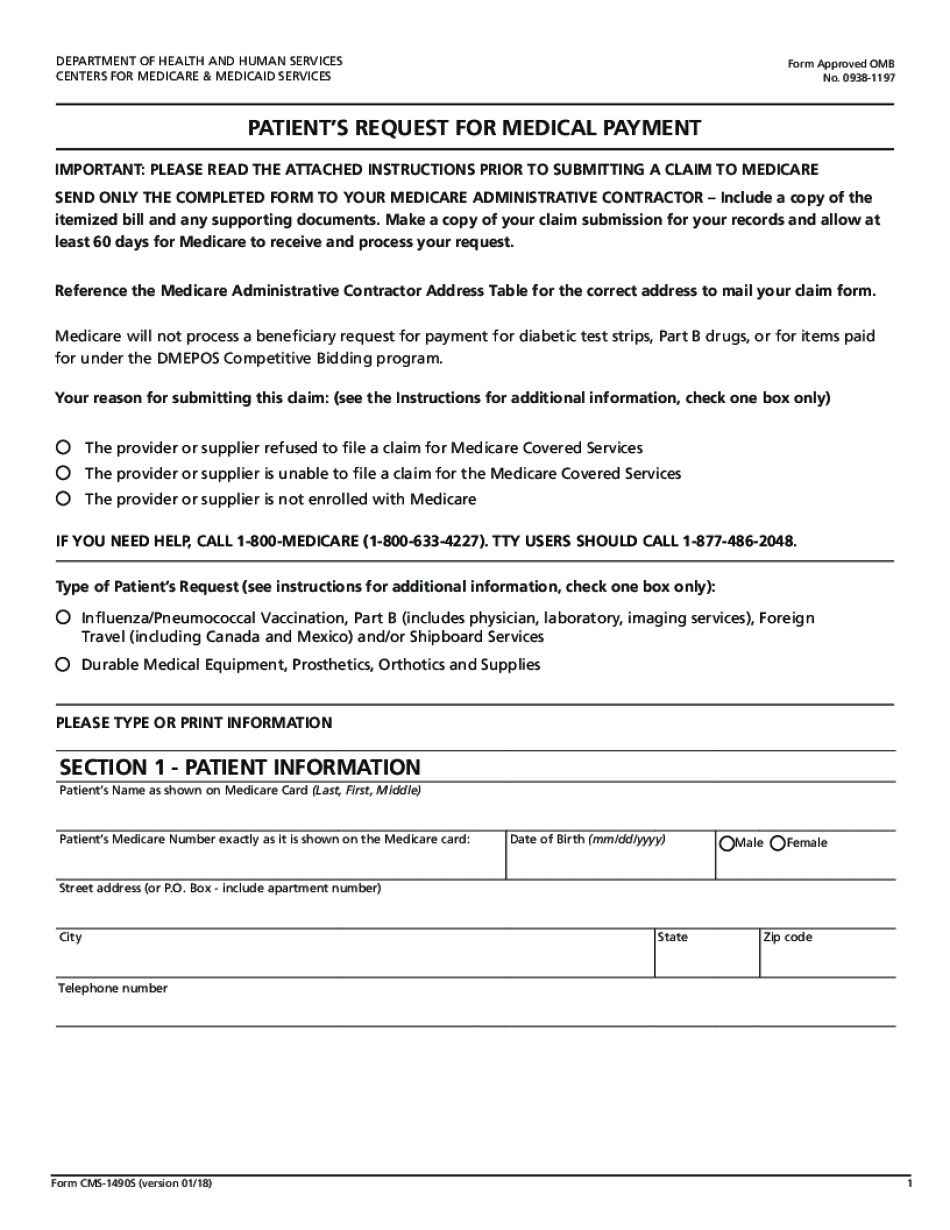

Medicare provider claims Form: What You Should Know

You might also owe additional tax if you did not use Form 8685, which is used for 2017. Note If you need to wait until April 18 to file your return, you may apply for an extension by going to IRS.gov. If you are entitled to or claim the Health Coverage Tax Credit because of a change in your household or dependents, you MUST File Form 8885 on or before April 18, 2022. Complete part III of Form 8885, with “Application” in the first box. If you are entitled to or claim the Health Coverage Tax Credit because of a change in your household or dependents, you MUST File Form 8885 on or before April 18, 2022. Complete part I and part II. If you are entitled to or claim the Health Coverage Tax Credit because of a change in your household or dependents, you MUST Complete Part I and Part II. Include the following information on Form 8885: All the information you need to determine the amount of the health coverage tax credit for the tax year. Your COBRA payment information If you have health coverage, report on the Form 8885, Health Coverage Tax Credit Payment Record, the following information: The name and social security number of each COBRA covered individual, and the amount paid. Information about the health coverage in coverage plans with minimum essential coverage. If you used health insurance coverage other than qualified health plans as described above, and you are covered for treatment or services provided in a qualified health plan, report in Part IV of the Form 8885, Health Coverage Tax Credit Payment Record, the following information only for the coverage period that begins on or after June 5, 2016: If you were not covered for any part of the period, then include the following information, from the health coverage that was not paid for by you, for the period to the date of payment: The name and social security number of the coverage sponsor or a person paying the bill for coverage. If you were covered for less than a full period of treatment or services, then include the following information for the coverage period ending after the date of coverage: If you were covered for any part of the period, then include the following information, from the health coverage that was not paid for by you, for the applicable part of the period: The last day for you to pay the entire amount for the coverage.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form CMS-1490S, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form CMS-1490S online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form CMS-1490S by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form CMS-1490S from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Medicare provider claims